Get Started with Quotient’s Screener Builder Module Tutorial

It is a sound practice to think about which general stock universe you are interested in before bringing in excess data and potential noise to your stock selection process or study. You might unintentionally start with the MSCI All Country World Index and come to realize you are examining almost 3000 stocks in 47 developed and emerging markets. This is a ton of data to dissect.

If instead, you were to target companies of a specific sector, in a specific region, with sales in excess of $1 Billion, you could “screen” out all non-qualifiers and narrow your study to a reasonable number of names. Similarly, an ESG index might be an attractive starting point for fine tuning an ESG portfolio, while monitoring thinly traded or volatile stocks owned in high profile investment funds (e.g., Cathie Wood) could be helpful in mitigating your own portfolio risk if there was overlap.

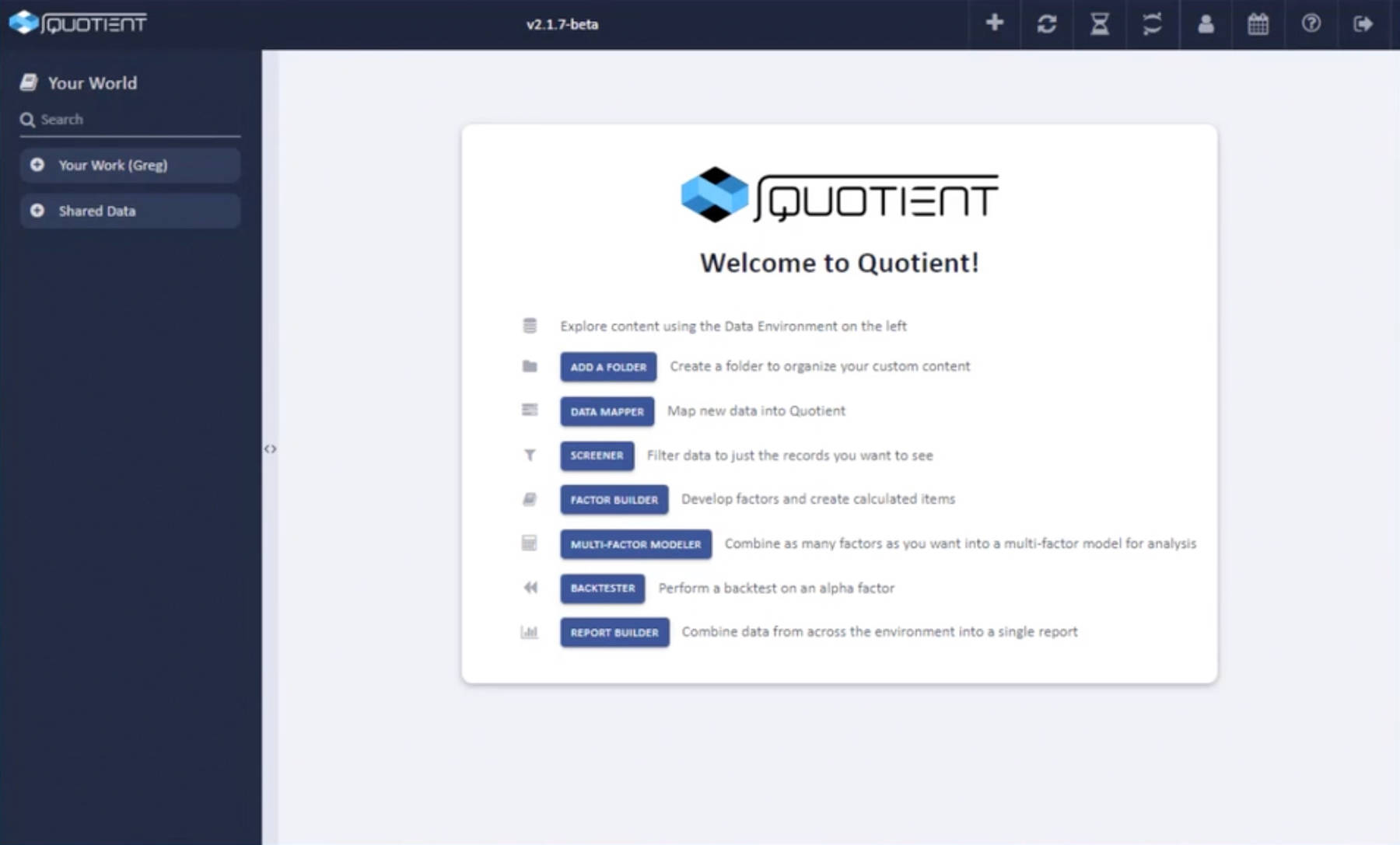

Quotient’s Screener Builder Module is where you can construct these universes or screens. Your mainstream data subscriptions (e.g., Compustat, Worldscope, S&P Indices) have been directly integrated into your Quotient environment and are readily available for more common screens, while Quotient’s Data Mapper functionality allows users to bring in both subscription-based and open-source data sets for highly differentiated screening objectives. These could include alternative data factors or uploaded constituents from an SEC 13F.

Take a look at our Screener Builder short intro video to get you started on your next successful investments thesis.