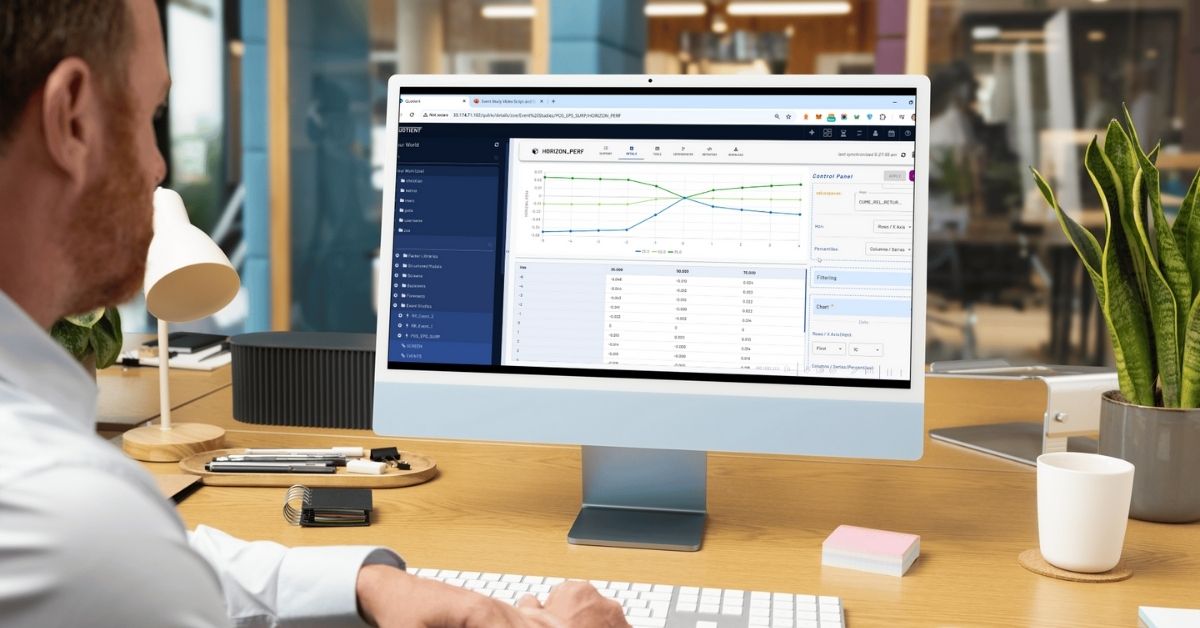

Introducing the Event Study Tool in Quotient by Scientific Financial Systems

Scientific Financial Systems proudly presents the Event Study tool, a standout feature of our flagship product, Quotient. Designed for financial professionals and researchers, this powerful tool streamlines the process of analyzing market reactions to significant events, enabling smarter, data-driven decision-making.

What is an Event Study?

An event study is a widely used analytical method in finance to measure the impact of specific occurrences, such as earnings announcements, regulatory changes, or geopolitical events, on stock prices and market behavior. By isolating these events, professionals can assess their effects on asset returns, providing critical insights into market efficiency and investor sentiment.

The Event Study Tool: Features and Benefits

Our Event Study tool integrates cutting-edge technology with user-friendly design, ensuring you can conduct comprehensive analyses with minimal effort. Here’s what makes it indispensable:

- Customizable Event Windows: Define pre- and post-event periods to capture a complete picture of market reactions.

- Robust Statistical Outputs: Access a range of metrics, including abnormal returns, cumulative abnormal returns, and significance tests, to validate your hypotheses.

- High-Speed Processing: Analyze extensive datasets in seconds, saving valuable time for deeper analysis.

- Interactive Visualization: Visualize results with intuitive charts and graphs, enhancing understanding and presentation.

- Seamless Integration: Import data from multiple sources and export results for use in reports or presentations.

Who Can Benefit?

The Event Study tool is tailored for a wide range of users:

- Quantitative Analysts: Evaluate how events influence stock performance and market trends.

- Institutional Investors: Make informed investment decisions based on historical and real-time data.

- Academic Researchers: Conduct rigorous studies on market behaviors and publish high-impact findings.

- Corporate Strategists: Understand shareholder responses to strategic decisions, such as mergers or product launches.

Watch the Video

Real-World Applications

- Earnings Announcements: Measure the impact of quarterly earnings on stock prices to gauge market expectations.

- Policy Changes: Analyze how regulatory updates affect industry sectors or individual companies.

- Market Shocks: Study investor reactions to geopolitical events or natural disasters.

- Product Launches: Assess the financial implications of new product introductions on company valuations.

Why Choose Quotient?

Quotient is more than a tool—it’s a complete solution for financial analysis. With its advanced capabilities and intuitive design, the Event Study tool exemplifies our commitment to empowering users with actionable insights. Whether you’re navigating turbulent markets or uncovering hidden opportunities, Quotient equips you with the tools needed to succeed.

Get Started Today

Elevate your financial analysis with the Event Study tool in Quotient. Join the community of professionals transforming data into decisions. Contact us to learn more or schedule a demo.

By leveraging the power of Quotient, you can gain a significant edge in the markets.

Contact us now to learn more and request a free trial.

Discover the future of financial data analysis

Watch a demonstration of Quotient™, our flagship financial data analysis product.